What Is the Best Forex Chart for Day Trading?

Day trading in the forex market requires quick decision-making based on accurate, real-time data. The right chart type and timeframe can make a big difference in how efficiently you analyze market movements and place trades.

In this post, you’ll discover the best forex chart formats and timeframes for day trading, along with tips for using them effectively.

Most Popular Forex Chart Types for Day Traders

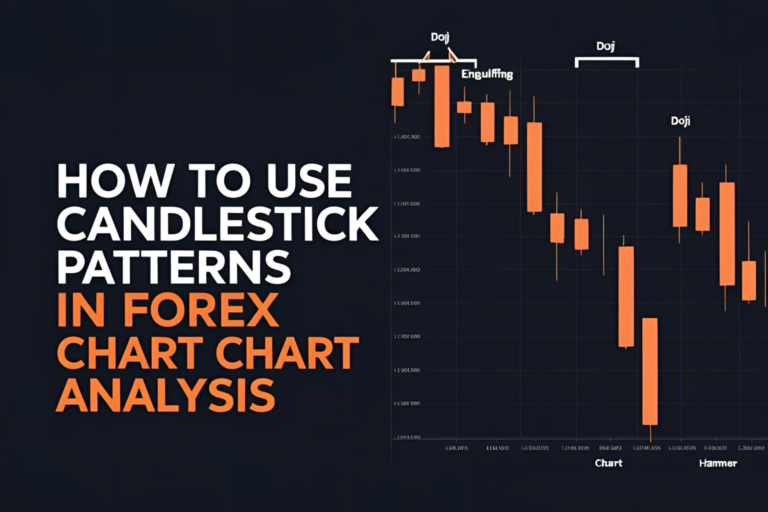

1. Candlestick Chart

The candlestick chart is the most commonly used by day traders due to its visual clarity. Each candle shows the open, high, low, and close of a selected timeframe, making it easier to interpret price action and identify patterns.

2. Line Chart

This chart connects closing prices with a simple line. It’s less detailed but useful for spotting overall trends quickly.

3. Bar Chart

Displays the same information as a candlestick chart but in a different style. Less popular than candlesticks among retail traders.

Recommendation:

Use candlestick charts for intraday trading. They provide more insights into price behavior within short intervals.

Best Timeframes for Day Trading Charts

1. 5-Minute (M5) Chart

Offers fast updates and is ideal for quick trades with small targets.

2. 15-Minute (M15) Chart

Balances signal frequency and clarity. Useful for identifying minor trends and breakout opportunities.

3. 1-Hour (H1) Chart

Useful for spotting the day’s key support and resistance levels and understanding broader movement before entering shorter-term trades.

Best Practice:

Use multi-timeframe analysis. For example:

- H1 for trend direction

- M15 for setup

- M5 for precise entry

Charting Features to Look For

- Real-time updates with minimal delay

- Drawing tools (trendlines, zones, patterns)

- Built-in indicators like RSI, MACD, Moving Averages

- Ability to set alerts for key price levels

Recommended Platforms for Day Trading Charts

- TradingView: Real-time data, cloud access, fast chart loading

- MT4: Broker-connected with advanced features and customization

- cTrader: Precise execution and intuitive interface

Tips for Day Traders Using Charts

- Keep charts clean and avoid excessive indicators

- Always trade with a stop-loss level

- Use price action near key levels as confirmation

- Be aware of news events that may cause volatility during your trading session

Final Thoughts

For day trading, candlestick charts on 5-minute to 15-minute timeframes offer the best balance between speed and detail. Combine these with clean support and resistance zones, trendlines, and one or two reliable indicators to improve accuracy.

The right chart setup can streamline your strategy and help you execute trades with confidence.

FAQs

1. What is the most reliable chart for day trading?

The candlestick chart is considered the most reliable due to the level of detail it provides for short-term traders.

2. Which timeframe is best for forex day trading?

15-minute and 5-minute charts are popular choices, often used in combination with higher timeframes for confirmation.

3. Can I day trade forex with just one chart?

It’s possible, but using multiple timeframes helps improve entry timing and reduce false signals.

4. What chart platform do most day traders use?

TradingView and MT4 are among the most widely used platforms due to their flexibility and speed.

5. How do I practice using day trading charts?

Open a demo account with a broker or use a free charting platform like TradingView to test your analysis in real-time conditions.