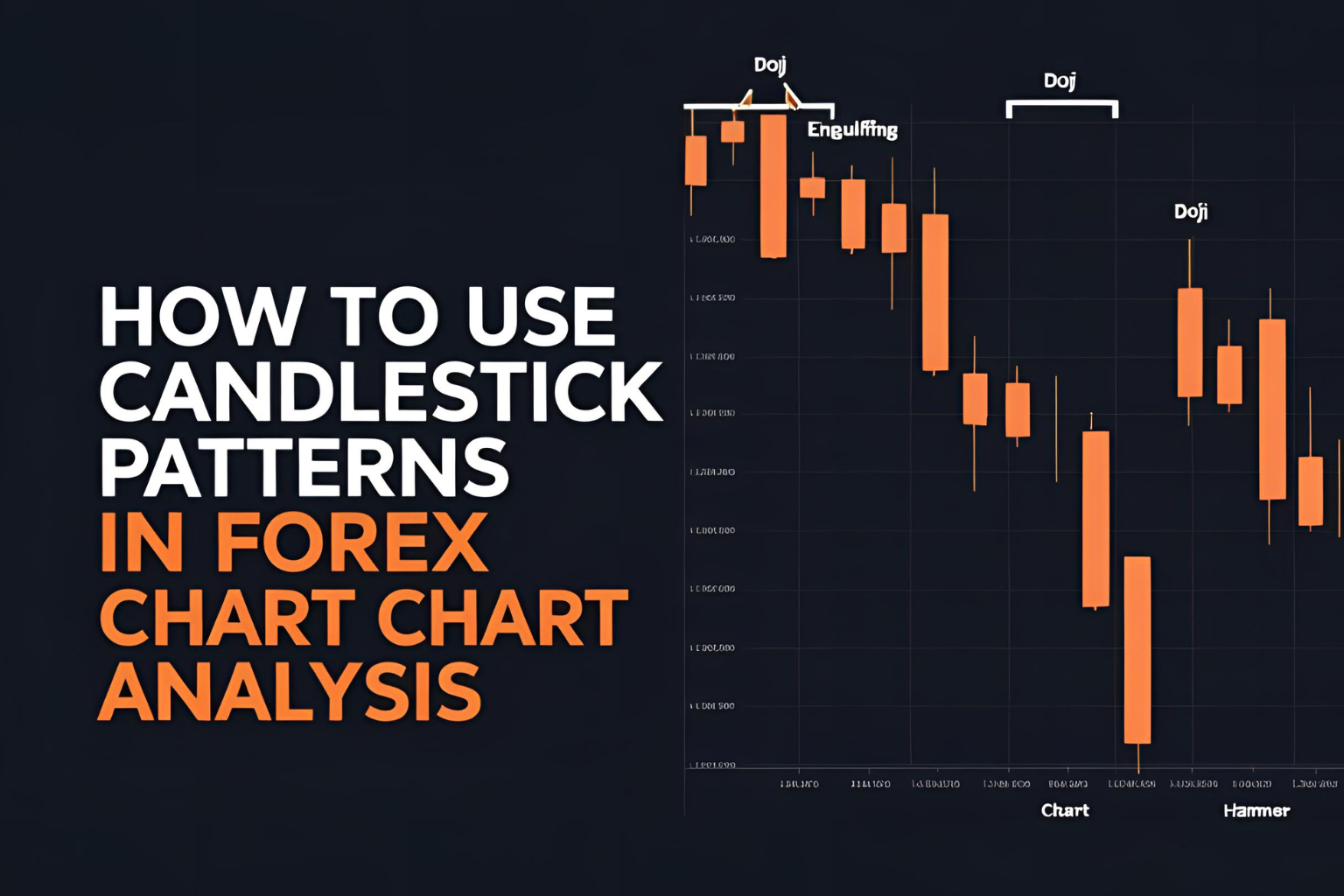

How to Use Candlestick Patterns in Forex Chart Analysis

Candlestick patterns are one of the most reliable and time-tested methods for analyzing price action in the forex market. They offer insight into market sentiment and potential reversals or continuations.

In this guide, you’ll learn how to recognize and apply major candlestick patterns in your forex chart analysis.

What Are Candlestick Patterns?

A candlestick is a single price bar that shows the open, high, low, and close within a specific time period. When multiple candles form recognizable sequences, they create candlestick patterns that traders use to forecast price direction.

Candlestick patterns are often classified as:

- Reversal patterns

- Continuation patterns

- Indecision or neutral patterns

Top Reversal Candlestick Patterns

1. Engulfing Pattern

- A larger candle completely engulfs the previous one.

- Bullish engulfing appears after a downtrend.

- Bearish engulfing appears after an uptrend.

2. Pin Bar (or Hammer / Shooting Star)

- A small body with a long wick indicates price rejection.

- Hammer (bullish) appears at the bottom of a trend.

- Shooting Star (bearish) appears at the top.

3. Doji

- Candle with almost equal open and close.

- Signals indecision; context matters for interpretation.

Top Continuation Candlestick Patterns

1. Rising Three Methods

- A bullish candle followed by a few small bearish candles, then another strong bullish candle.

- Suggests continuation of the uptrend.

2. Falling Three Methods

- The reverse of the above, confirming downtrend continuation.

How to Use Candlestick Patterns Effectively

- Always confirm patterns with market context.

- Combine with support and resistance zones.

- Use multiple timeframes to validate the signal.

- Confirm with indicators like RSI or Moving Averages.

- Wait for candle close before taking a trade.

Candlestick Chart vs Bar Chart

Candlestick charts offer visual clarity and faster decision-making compared to traditional bar charts. Most traders prefer them due to the psychological insights they provide into market behavior.

Common Mistakes to Avoid

- Trading a pattern without confirmation from price context

- Using patterns on low-volume or illiquid pairs

- Ignoring higher timeframes or trend direction

Final Thoughts

Candlestick patterns are powerful tools for forex traders. They allow you to anticipate shifts in momentum and recognize opportunities early. Focus on mastering a few key patterns first and then expand your knowledge with practice and chart review.

FAQs

1. Are candlestick patterns reliable in forex trading?

Yes, especially when confirmed by support, resistance, or indicators. They are not foolproof but can increase trade probability.

2. Can I trade using only candlestick patterns?

While some traders do, it’s better to combine them with other forms of analysis for better results.

3. Which is the most reliable candlestick pattern?

Engulfing and pin bar patterns are widely considered among the most reliable.

4. Do these patterns work on all timeframes?

Yes, but they are generally more reliable on higher timeframes like H1 and above.

5. What platform is best for studying candlestick patterns?

TradingView, MT4, and Investing.com offer excellent charting tools to practice and apply candlestick patterns.